Is hydrogen the future of clean energy? EPO analysis of innovation and patenting trends in hydrogen technologies

Climate change is an increasingly prevalent driver of innovation in many fields of science and technology, not least of which is the energy sector. While the use of hydrogen as an energy source has been known and understood for decades, the widespread use of hydrogen is largely limited by pitfalls in infrastructure. For example, the UK National Grid is only due to start testing the use of hydrogen in 2023, with actual implementation looking to be much further in the future. Nonetheless, hydrogen represents the possibility for a fully decarbonised energy source.

National gas FutureGrid programme

FutureGrid is a programme which seeks to build a hydrogen test facility in Northern England.

Read moreIn January 2023, a report of a joint study between the European Patent Office (EPO) and the International Energy Agency (IEA) was published outlining an analysis of innovative activities along hydrogen value chains, and particularly reviewing trends in patent applications regarding inventions in hydrogen technology between 2001 and 2020. This report provides an overview on the primary areas of innovation in various aspects of hydrogen technology and the actors that are driving this innovation.

Taking a high-level overview of patenting activity for hydrogen technology, the report finds that the rate of applications for international patent families (IPFs) worldwide is generally increasing. This is corroborated by the 18% year on year growth in hydrogen-related patent applications since 2005 by an earlier EPO study.

Patent insight report: innovation trends in electrolysers for hydrogen production

EPO and IRENA (2022), Patent insight report. Innovation trends in electrolysers for hydrogen production, EPO, Vienna.

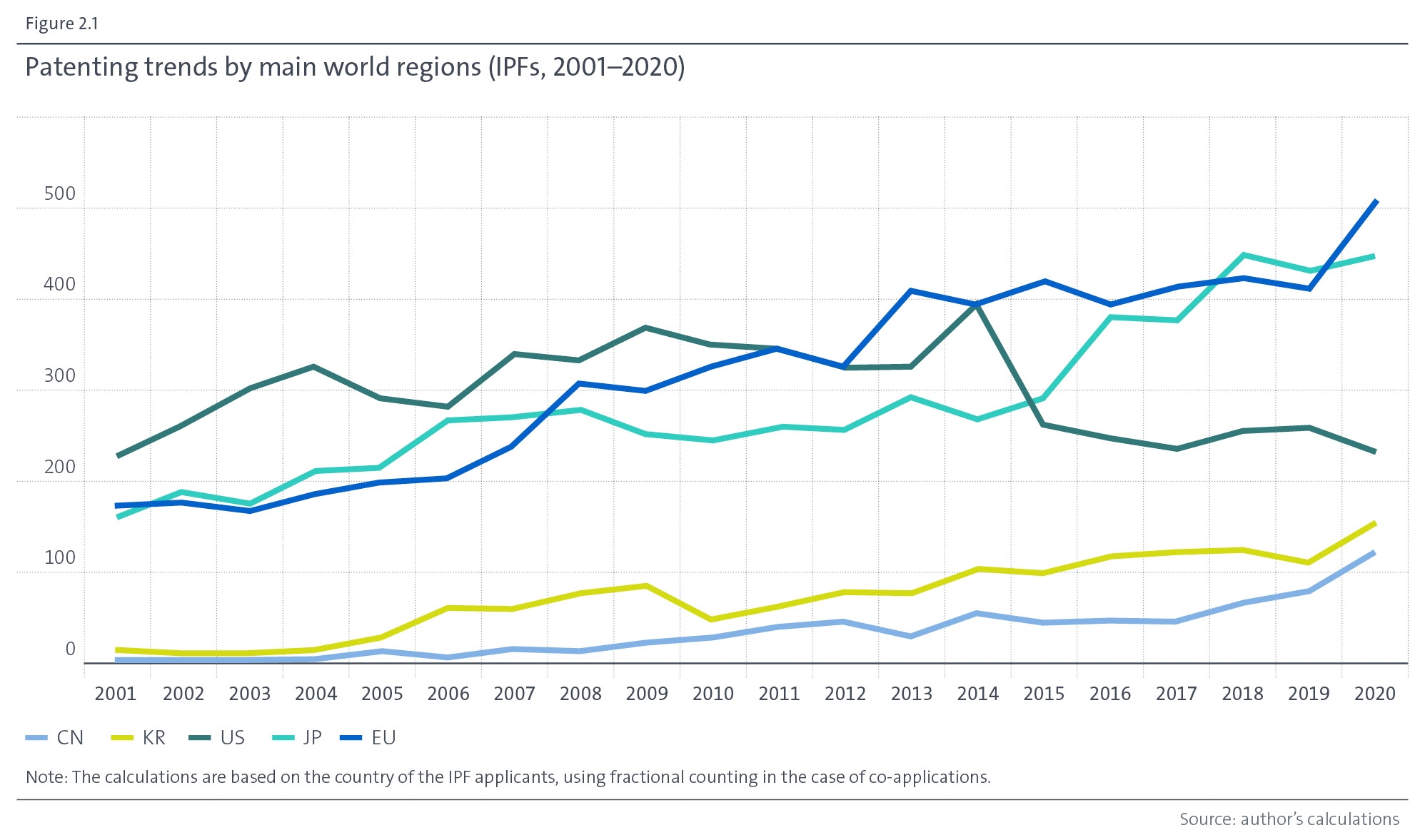

Read moreA clear majority of global IPFs comes from EU countries, Japan, and the US, with the EU and Japan contributing more than half of the IPFs in the period of 2011-2020 (28% and 24% respectively). The US notably had a significant drop in IPFs around 2015, despite being a world leader up until 2010. South Korea and China exhibit the beginnings of an increase in IPFs in 2019, but for now remain in the minority of applicants (see figure 2.1 below).

The report finds that different regions appear to focus on different sectors of hydrogen technology. Specifically, the report splits hydrogen IPFs into three main categories: (1) hydrogen production, (2) hydrogen storage/distribution and transformation, and (3) end-use applications.

Hydrogen production

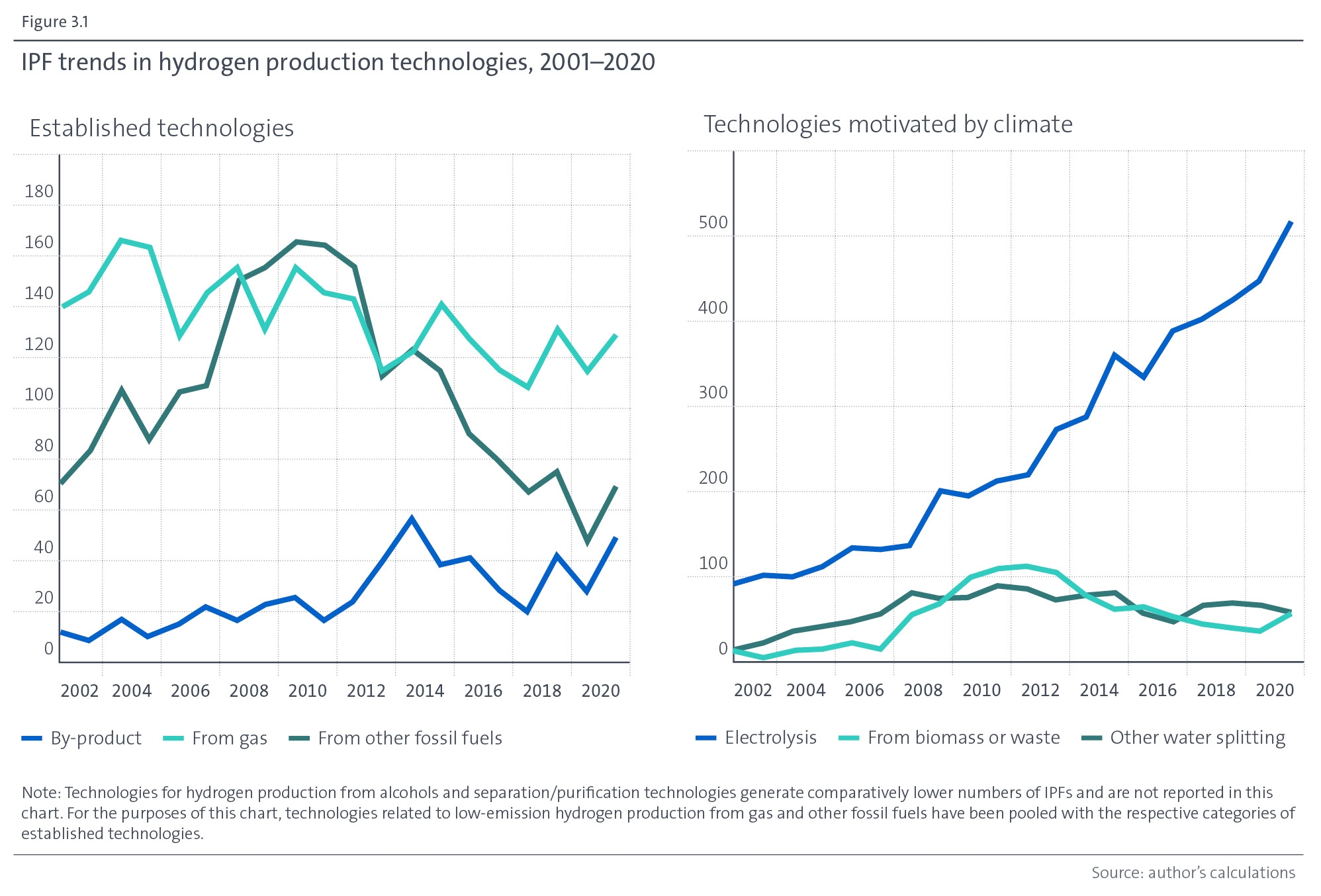

IPFs for hydrogen production between 2001 and 2020 primarily focus on two sources of hydrogen: fossil fuels and water electrolysis. While fossil fuels are the most common means of producing hydrogen used today (with natural gas alone accounting for around 60%), the report finds that the rate of IPFs relating to electrolysis is increasing rapidly. Over 5,000 electrolysis-based IPFs were published between 2001 and 2020, primarily from Japanese and European applicants (see figure 3.1 below).

As would be expected, fossil fuels cannot be considered as a viable option for achieving a decarbonised energy source. But electrolysis has the potential for a true zero emission source of hydrogen if powered by renewable or nuclear electricity. The recent surge in patenting activity around electrolysis could indicate a future shift in the proportion of hydrogen production towards electrolysis. Furthermore, with the increase of natural gas prices in 2022, governments around the world could face increasing pressures to consider new forms of energy production.

Hydrogen storage, distribution and transformation

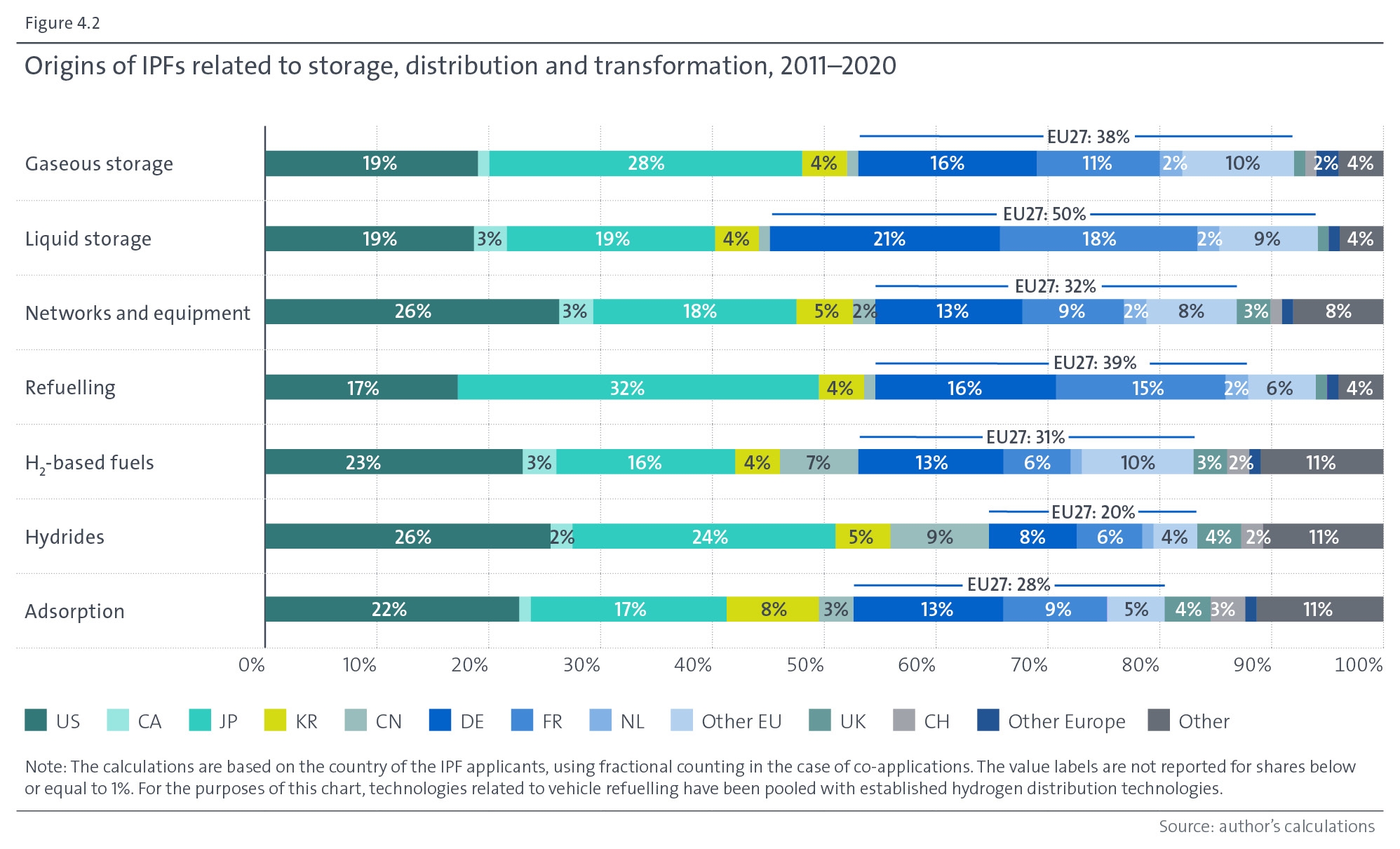

The relatively low energy density of hydrogen presents many challenges for storage and distribution. The report finds many IPFs relating to liquefaction and regasification, solid fuels, and reversible chemical transformations in order to store hydrogen more efficiently. A significant proportion of the patenting activity in this area originates from large European chemical companies (such as Air Liquide or Linde), contributing to 38% of gaseous storage IPFs and 50% of liquid storage IPFs between 2011 and 2020. Japanese automotive companies (such as Toyota and Honda) also contribute a considerable amount towards gaseous storage technology (see figure 4.2 below).

As an alternative to storing hydrogen in a pure gas or liquid form, the report also notes an increase in IPFs for synthetic fuels to “carry” hydrogen in a more efficient form. This primarily includes ammonia cracking and liquid organic hydrogen carriers. This technology appears to be relatively immature, with most IPFs originating from universities and public research organisations.

End-use applications

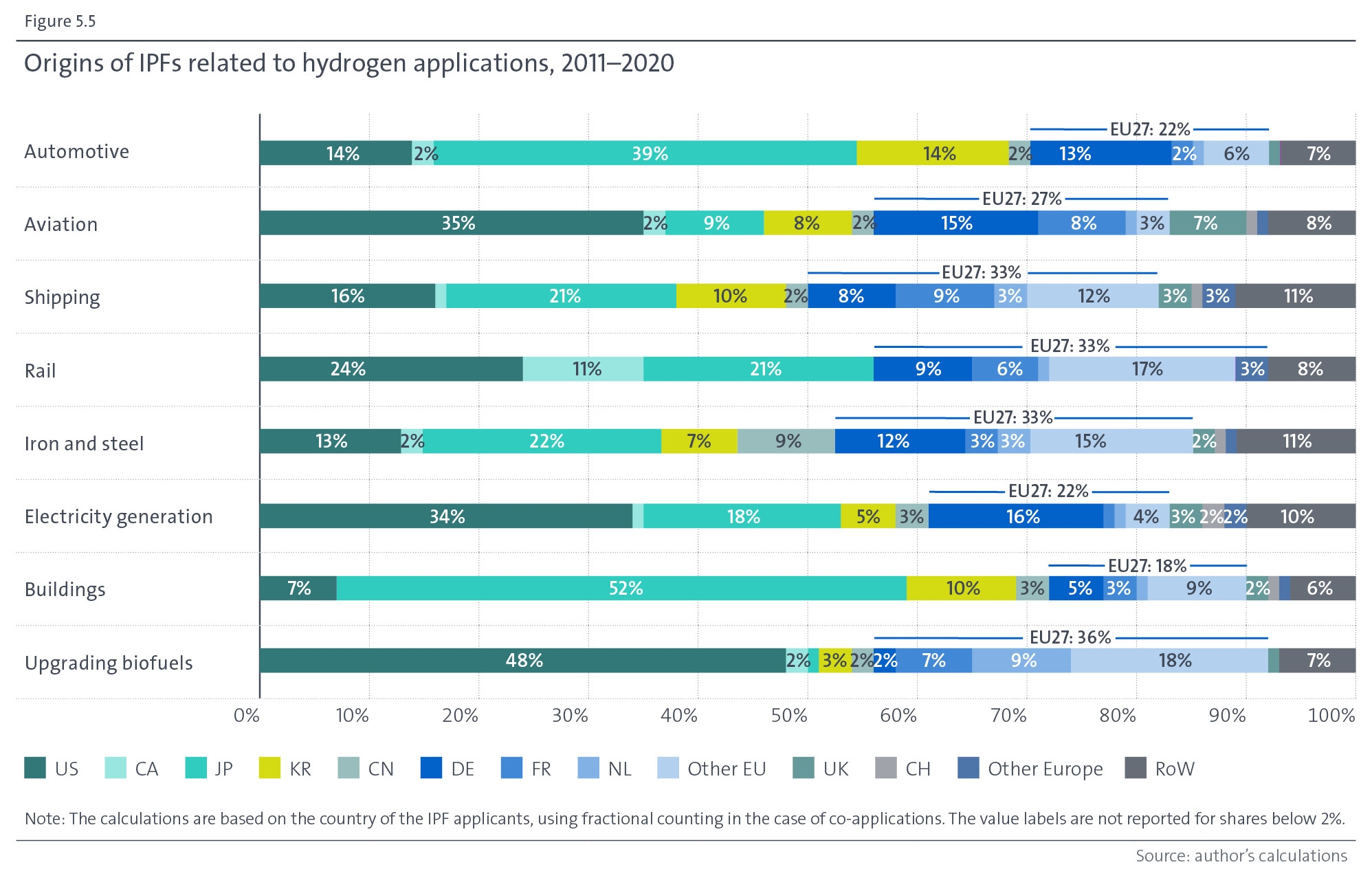

There is a broad range of end-use applications that propose to make use of hydrogen as an alternative to fossil fuels. An overwhelming proportion of end-use application IPFs since 2001 is in the automotive industry, with over 350 IPFs in 2020 alone. Japanese applicants, such as Toyota and Honda, are the biggest contributors to the automotive industry, with US applicants leading in aviation and European applicants leading in shipping (see figure 5.5 below).

Beyond transport, other emerging uses include electricity generation, iron and steel production, and use in buildings (for example,heating). However, the report notes no clear trends towards innovation in these areas. Indeed, there appears to be an overall drop in patenting in each of these emerging uses.

What to expect for the future?

From the patenting trends identified in this report, there is an opportunity to speculate on the future of hydrogen technology. As climate change continues to drive technological development, recent patenting activity indicates further development towards low-emission hydrogen production through large-scale electrolysis. The improvements in gaseous and liquid hydrogen transportation can then be used to support the quickly growing hydrogen-based transportation sector.

Useful links

- “Hydrogen patents for a clean energy future: A global trend analysis of innovation along hydrogen value chains”, published by the European Patent Office (EPO) and the International Energy Agency (IEA), January 2023: dycip.com/hydrogenpatents.

Please refer to the EPO report for a full list of citations and further information about source data for figures.

We thank the EPO for giving us permission to reproduce figures from the report.